Readings Newsletter

Become a Readings Member to make your shopping experience even easier.

Sign in or sign up for free!

You’re not far away from qualifying for FREE standard shipping within Australia

You’ve qualified for FREE standard shipping within Australia

The cart is loading…

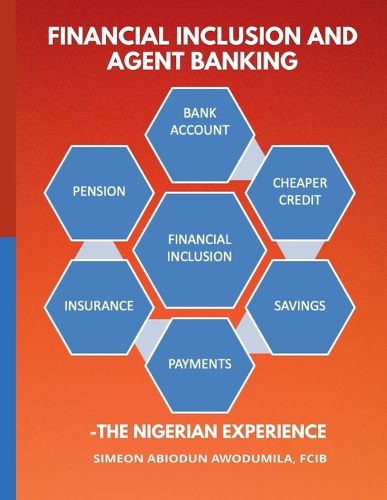

Every Nation desires to have an inclusive growth in its economy; a thriving economy where every adult will have access to financial services that will meet their purposes at affordable cost. In actualizing the above goal, the world financial bodies have tagged this process of getting every adult population to have access to finance as financial inclusion or financial exclusion depending on which angle one is looking at the issue. Financial inclusion and financial exclusion are like the two sides of a coin. If you are looking at the inclusion side of the coin, you are concentrating on the percentage of adult population that has access to financial services. On the flip side of the coin, when you talk of financial exclusion, one will be concentrating on the percentage of adult population that does not have access to any financial products or services.

The high income countries are doing better in financial inclusion, as most of these countries are recording about 90 percent plus financial inclusion rate. Most of these countries because of their demographics such as Age, Education or Literacy level, economic and social factors, technological advancement and financial innovation have gone far ahead of emerging economies in embracing financial inclusion. The introduction of Agent banking has also contributed to the closing of the financial inclusion gap in these jurisdictions. In this book we shall be looking at financial inclusion and Agent Banking in some jurisdictions such as Europe, Asia, some African countries and finally in Nigeria. The Nigerian financial inclusion and Agent Banking experience will be dealt with comprehensively.

$9.00 standard shipping within Australia

FREE standard shipping within Australia for orders over $100.00

Express & International shipping calculated at checkout

Every Nation desires to have an inclusive growth in its economy; a thriving economy where every adult will have access to financial services that will meet their purposes at affordable cost. In actualizing the above goal, the world financial bodies have tagged this process of getting every adult population to have access to finance as financial inclusion or financial exclusion depending on which angle one is looking at the issue. Financial inclusion and financial exclusion are like the two sides of a coin. If you are looking at the inclusion side of the coin, you are concentrating on the percentage of adult population that has access to financial services. On the flip side of the coin, when you talk of financial exclusion, one will be concentrating on the percentage of adult population that does not have access to any financial products or services.

The high income countries are doing better in financial inclusion, as most of these countries are recording about 90 percent plus financial inclusion rate. Most of these countries because of their demographics such as Age, Education or Literacy level, economic and social factors, technological advancement and financial innovation have gone far ahead of emerging economies in embracing financial inclusion. The introduction of Agent banking has also contributed to the closing of the financial inclusion gap in these jurisdictions. In this book we shall be looking at financial inclusion and Agent Banking in some jurisdictions such as Europe, Asia, some African countries and finally in Nigeria. The Nigerian financial inclusion and Agent Banking experience will be dealt with comprehensively.