Readings Newsletter

Become a Readings Member to make your shopping experience even easier.

Sign in or sign up for free!

You’re not far away from qualifying for FREE standard shipping within Australia

You’ve qualified for FREE standard shipping within Australia

The cart is loading…

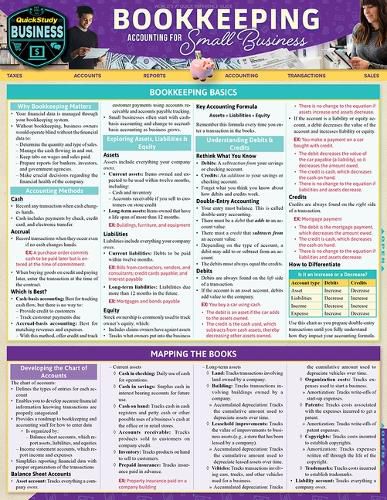

Complete and essential reference to the process of bookkeeping for your business. This 6 page laminated guide includes the facts you need to ensure a well organized system for tracking expenses and profits enabling business owners to produce reports that will satisfy bankers for loan requirements, investors for raising cash, and government agencies for reporting data accurately to avoid penalties and interest. Author of over 40 books, financial specialist Lita Epstein, masterfully designed a reference that is an expert’s concise notes for building a system and ensuring that system is thorough. As an expert or new business owner this reference can elevate your understanding and vocabulary to be your company’s financial expert.

6 page laminated reference guide includes:

Bookkeeping Overview

Accounting Methods Exploring Assets, Liabilities & Equity Understanding Debits & Credits

Mapping the Books

Developing the Chart of Accounts

Using Your Business Map

Journals General Ledgers Reports Computerized Accounting Programs

Internal Controls

Protecting Your Business’s Cash Documenting Transactions Protecting Against Fraud Employee Bonding

Entering Key Transactions

Inventory Purchases

Hiring Staff

Completing Government Forms for New Hires Determining Pay Periods Wage & Salary Types Social Security & Medicare Unemployment Taxes Worker’s Compensation

Testing for Accuracy

Proving the Cash & Inventory Finalizing Cash Receipts Inventory Adjusting for Errors Closing the Journals Using Summary Results

Prepping Books for a New Accounting Cycle

Steps in The Accounting Cycle Adding or Deleting Accounts Reviewing Customer Accounts Assessing Vendor Accounts Starting a New Bookkeeping Year

Preparing Financial Reports

Balance Sheet Income Statement Internal Reports Other External Reports

$9.00 standard shipping within Australia

FREE standard shipping within Australia for orders over $100.00

Express & International shipping calculated at checkout

Stock availability can be subject to change without notice. We recommend calling the shop or contacting our online team to check availability of low stock items. Please see our Shopping Online page for more details.

Complete and essential reference to the process of bookkeeping for your business. This 6 page laminated guide includes the facts you need to ensure a well organized system for tracking expenses and profits enabling business owners to produce reports that will satisfy bankers for loan requirements, investors for raising cash, and government agencies for reporting data accurately to avoid penalties and interest. Author of over 40 books, financial specialist Lita Epstein, masterfully designed a reference that is an expert’s concise notes for building a system and ensuring that system is thorough. As an expert or new business owner this reference can elevate your understanding and vocabulary to be your company’s financial expert.

6 page laminated reference guide includes:

Bookkeeping Overview

Accounting Methods Exploring Assets, Liabilities & Equity Understanding Debits & Credits

Mapping the Books

Developing the Chart of Accounts

Using Your Business Map

Journals General Ledgers Reports Computerized Accounting Programs

Internal Controls

Protecting Your Business’s Cash Documenting Transactions Protecting Against Fraud Employee Bonding

Entering Key Transactions

Inventory Purchases

Hiring Staff

Completing Government Forms for New Hires Determining Pay Periods Wage & Salary Types Social Security & Medicare Unemployment Taxes Worker’s Compensation

Testing for Accuracy

Proving the Cash & Inventory Finalizing Cash Receipts Inventory Adjusting for Errors Closing the Journals Using Summary Results

Prepping Books for a New Accounting Cycle

Steps in The Accounting Cycle Adding or Deleting Accounts Reviewing Customer Accounts Assessing Vendor Accounts Starting a New Bookkeeping Year

Preparing Financial Reports

Balance Sheet Income Statement Internal Reports Other External Reports