Readings Newsletter

Become a Readings Member to make your shopping experience even easier.

Sign in or sign up for free!

You’re not far away from qualifying for FREE standard shipping within Australia

You’ve qualified for FREE standard shipping within Australia

The cart is loading…

South Africa's banking miracle was built on exploitation, deception, and the Stellenbosch elite's conviction that their secrets would remain buried forever. They were wrong.

The story begins with the collapse of Boland Bank, a casualty of creative accounting and reckless management by an executive with no banking background, and it evolves into one of South Africa's greatest post-apartheid success stories, Capitec Bank.

When you build a bank this big, this fast, you don't always play by the rules.

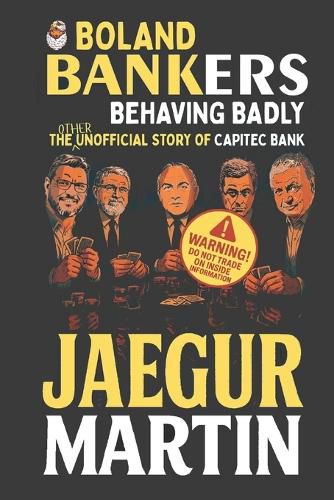

In the high-stakes world of finance, where every number hides a story, Boland Bankers Behaving Badly unravels the tangled saga behind Capitec's meteoric rise-a tale of ambition, audacity, and the cost of cutting corners.

It all began in 1994 when Christo Wiese introduced Michiel Le Roux to the world of banking, setting in motion the so-called 'dream team' whose reckless mismanagement would drive Boland Bank into collapse. Led by executives with no banking pedigree, Boland's downfall was marked by toxic loan books, unauthorised bonuses, and accounting practices that raised more questions than answers-starting from the very first results under Financial Director Andre Ben le Grange.

You will learn that Viceroy Research was not incorrect in finding issues with reconciling Capitec's loan book. It was just that they had not yet linked the discrepancies to "grey zone" accounting.

Drawing on years of meticulous research-and an admittedly unhealthy obsession-this book exposes the risks ignored, the truths left unspoken, and the lessons history dares to teach. For anyone invested in South Africa's financial future, Boland Bankers Behaving Badly is a gripping, urgent read that pulls no punches and leaves no stone unturned.

$9.00 standard shipping within Australia

FREE standard shipping within Australia for orders over $100.00

Express & International shipping calculated at checkout

South Africa's banking miracle was built on exploitation, deception, and the Stellenbosch elite's conviction that their secrets would remain buried forever. They were wrong.

The story begins with the collapse of Boland Bank, a casualty of creative accounting and reckless management by an executive with no banking background, and it evolves into one of South Africa's greatest post-apartheid success stories, Capitec Bank.

When you build a bank this big, this fast, you don't always play by the rules.

In the high-stakes world of finance, where every number hides a story, Boland Bankers Behaving Badly unravels the tangled saga behind Capitec's meteoric rise-a tale of ambition, audacity, and the cost of cutting corners.

It all began in 1994 when Christo Wiese introduced Michiel Le Roux to the world of banking, setting in motion the so-called 'dream team' whose reckless mismanagement would drive Boland Bank into collapse. Led by executives with no banking pedigree, Boland's downfall was marked by toxic loan books, unauthorised bonuses, and accounting practices that raised more questions than answers-starting from the very first results under Financial Director Andre Ben le Grange.

You will learn that Viceroy Research was not incorrect in finding issues with reconciling Capitec's loan book. It was just that they had not yet linked the discrepancies to "grey zone" accounting.

Drawing on years of meticulous research-and an admittedly unhealthy obsession-this book exposes the risks ignored, the truths left unspoken, and the lessons history dares to teach. For anyone invested in South Africa's financial future, Boland Bankers Behaving Badly is a gripping, urgent read that pulls no punches and leaves no stone unturned.